Small-cap funds are popular right now. Should you, however, join this bandwagon?

Small-cap funds are popular right now. Should you, however, join this bandwagon?

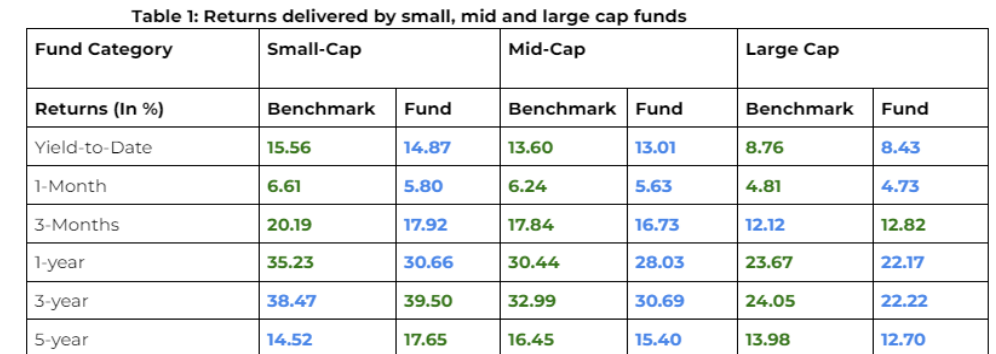

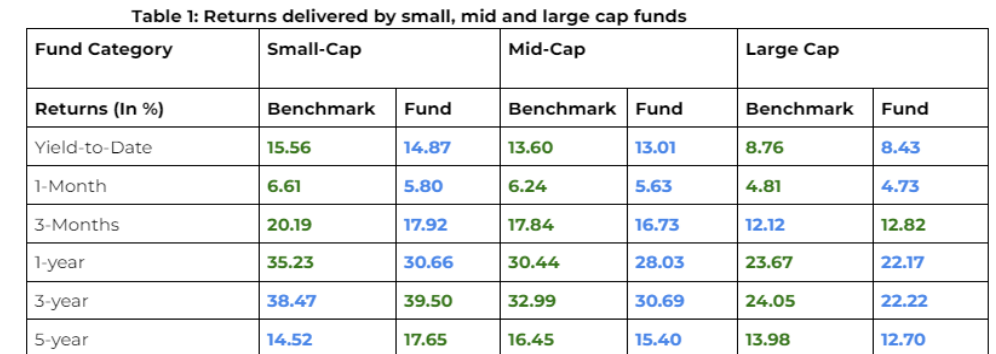

Today marks the day when the S&P BSE SmallCap index reached a new all-time high point value of 33,358.31 points. The fact that small caps have been showing consistent profitability over both long and short time frames has made them the most popular choice among investors right now. While this may explain why the market has a good emotion towards them, the question remains whether or not now is the correct market moment to get on board with the small-cap juggernaut.

What’s the big hurry?

Notes “Small caps are in vogue because with the market currently on the bull run, their valuations are surging and, as a result, they are offering attractive returns,” said Nema Chhaya Buch, founder of Pune-based Wishing Tree Fin (OPC) Pvt. Ltd. Because of this, investors think that it will continue for a while longer, and as a result, they are being proactive in order to make the most out of this bull run.

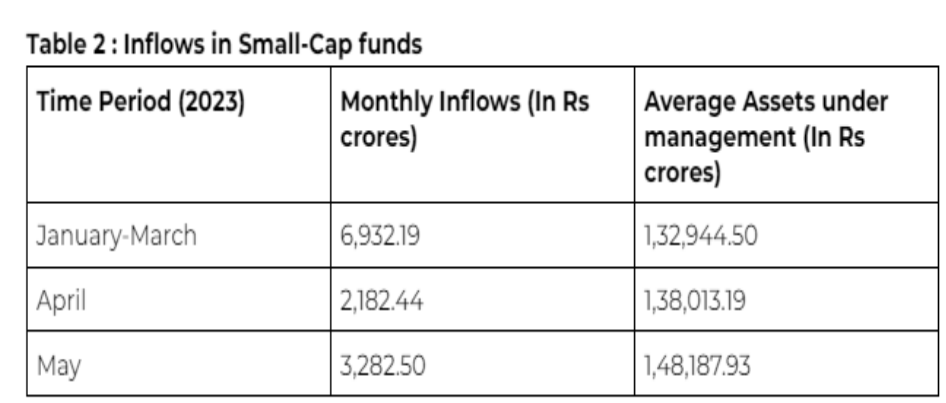

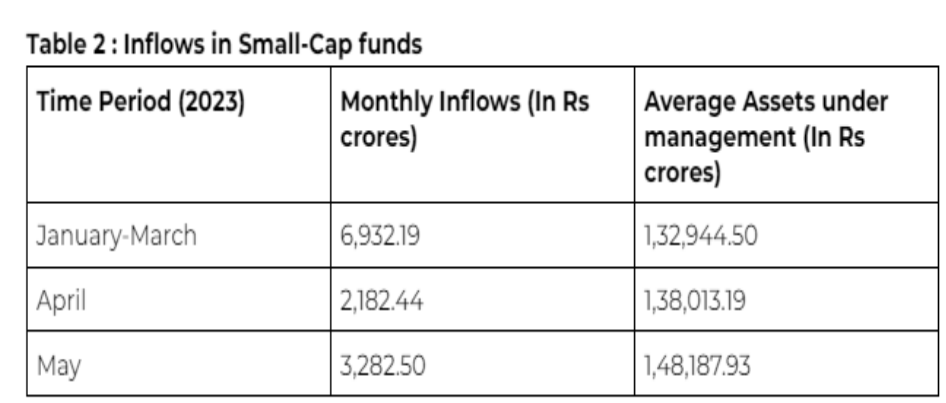

Small-cap mutual funds have had significant inflows of capital over the past six months, allowing them to rapidly accumulate wealth. According to Sanjeev Dawar, a financial adviser, the attractiveness of small-cap firms rests in their great potential to produce in terms of revenue, profitability, and growth as they progressively transition to becoming a mid-cap and finally, a large-cap company. In other words, the allure of small-cap companies resides in their ability to deliver.

In addition, RIA Kanika Shah notes that despite the surge in values, small-cap equities are still trading at a discount to large-cap companies. “When compared to large caps, small caps offer a wider variety of investment opportunities and themes.”

AMCs turn gatekeepers

In spite of this, it would be imprudent to throw all prudence and your hard-earned money into the wind merely because these funds provide the promise of rewards; doing so would be stupid. Because of the substantial increase in the number of investors entering small-cap funds, many mutual fund institutions have temporarily halted the process of accepting new subscriptions.

The most recent illustration of this is provided by the Nippon India Mutual Fund, which, just today, made the announcement that it will prohibit new subscriptions to the fund until further notice. However, in its statement, it made it clear that this will not have any impact on current SIPs. Additionally, it stated that SIPs and STPs (Systematic Investment/Transfer Plans) will be permitted with a daily limit of up to Rs 5 lakh for each PAN card.

In addition, Tata Capital halted all lump-sum contributions in the small-cap plan it manages one month ago. The use of STP and SIPs is not subject to any restrictions at this time. The maximum amount that may be invested each month in SBI’s small-cap programme through SIPs and STPs has already been set at Rs 25,000.

At least for the time being, this is a hint that the market in this sector is quite competitive. “fresh inflows in small-cap are exceeding the planned investments or the opportunity available in the small cap stocks space,” said Jay Thacker, an analyst with SEBI RIA. Fund companies have stopped accepting new memberships because there is an issue with there being too much liquidity in this market as a result of their not being enough quality equities accessible at reasonable pricing.

Is it time to diversify your holdings with some small-cap stocks?

According to Kaustubh Belapurkar, Director-Manager of Research at Morningstar India, you should only consider this option if your time horizon for the investment is at least ten years.

Although small-cap funds have the potential to be excellent wealth generators over the long run, investors should be aware that their short-term performance may be more volatile. As a result, investors should not ignore the importance of maintaining a healthy asset allocation while investing in this market, as he explains.

Buch is of the same opinion as a result of the fact that small-caps are the first to rise when markets are thriving and the first to sink when markets are not doing well. “When the market is experiencing a bull run, small caps will be the first to rise and show glamorous returns. However, when the market enters the bear phase, small caps will also be the first to fall that significantly.” Because of this, consumers have to evaluate their capacity for risk before embarking on the roller coaster ride that is taking advantage of the speed of the market, she emphasises.

Although some industry professionals recommend having up to 20% of your portfolio invested in this sector, Thacker cautions against doing so just from a long-term perspective.

Even when investing in a systematic investment plan, it is not advisable to put money into small-cap funds. At the very least, it should not be included in the primary portfolio of individual investors as an alternative for a dedicated fund,” he concludes.